Subject: GS 3

Syllabus: Economic Development

- Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

- Government Budgeting.

- Infrastructure: Energy, Ports, Roads, Airports, Railways, etc.

Investment models.

Questions

- National monetisation pipeline could be a game changer for the Indian economy, but at the same time, it is marred with various challenges. Discuss. (250 Words, 15 Marks)

- More than 30 years have passed since the reforms of 1991. Discuss the objectives of those reforms and what are the positive outcomes of them. (250 Words, 15 Marks)

Model Structure

1. National monetisation pipeline could be a game changer for the Indian economy, but at the same time, it is marred with various challenges. Discuss. (250 Words, 15 Marks)

Model Structure

Introduction:

- National Monetisation Pipeline is an initiative by the Government of India for resource mobilisation through monetisation of brownfield, but underutilised infrastructure assets. or

- The Union Budget 2021-22 identifies monetisation of public assets as one of the three pillars for infrastructure financing in the country.

Main Body:

NMP as a game changer for the economy:-

- Mobilising resources for the creation of capital assets and meeting the infrastructure requirements of the country.

- Ensures resource efficiency in infrastructure operations and maintenance by leveraging private sector expertise.

- Reduced risk for the private sector as these are brownfield projects.

- There will not be inordinate delays owing to land and environmental clearances.

- It will enable Government-led capital creation to overcome the economic slowdown induced by the COVID-19 pandemic.

- Assist in quality job creation in the different sectors as envisioned by the programme.

Challenges in the implementation of the National monetisation pipeline are:

- Attracting private players: Privatisation in government companies such as Air India and BPCL or the PPP initiative in railways, did not attract enough private sector interest.

- Providing a balanced risk profile of assets: Making correct projections of risks associated with long-term projects in diverse sectors.

- Lack of identifiable revenue streams: in less profitable sectors, due to an immediate lack of revenue streams or poor investment sentiments for such sectors.

- Asset-specific Challenges:

- Low level of capacity utilisation in gas and petroleum pipeline networks,

- Regulated tariffs in the power sector assets.

- Low interest among investors in national highways below four lanes etc.

The following measures can help in overcoming the challenges:

- Development finance institution (DFI): DFIs can help in domain-specific assessment of risks and benefits, and in overseeing effective utilisation of mobilised resources.

- Dispute Resolution Mechanism: Efficient and effective dispute resolution will help improve the attractiveness of projects and assets.

- Transparent Bidding: Promotes trust and helps create a level playing field.

- Investor-friendly Taxation: There should be synergy between taxation and investment promotion measures in attracting foreign investments.

- Promotion of financial instruments such as Infrastructure investment trusts, Masala Bonds, etc.

Conclusion:

- National Monetisation Pipeline provides a critical diversification of options in mobilising resources for infrastructure expansion in the country. or

- Effective management of issues inherent to public-private partnerships, asset valuation, predictable government policies and execution will be crucial for success.

2. More than 30 years have passed since the reforms of 1991. Discuss the objectives of those reforms and what are the positive outcomes of them. (250 Words, 15 Marks)

Model Structure

Introduction

- Reforms are an ongoing process that were seen in the 1970s and 1980s, but the massive reforms of 1991 were a watershed moment in the history of the Indian economy. These reforms were a change from earlier highly regulated, bureaucratically controlled and strictly licensed systems.

Main Body

- The reforms of 1991 were labelled as liberalisation, privatisation and globalisation. Its objectives were -

- De-licensing of items that were an exclusive domain of MSMEs by following a forward-looking policy.

- Liberal norms for foreign investments, which were selective in earlier times due to fear of pulling out of investments due to fed increasing rates and also the impact on local businesses.

- For economic reforms to succeed, fiscal stabilisation is a precondition. Fiscal deficit reached 8.4-8.6% and it was necessary to reduce it by restructuring expenditure and subsidies, along with the abolition of export subsidies.

- Tax reforms like a reduction in income tax and corporate tax.

- Financial sector reforms like opening the banking sector to private players, statutory powers to SEBI, etc.

- With the changing global scenario and domestic needs, the reforms were significant and have had a positive impact.

- Better investment scenario and steadily increasing foreign investments, which has eased the burden on the fiscal deficit and government spending to some extent.

- Capital availability is a major factor driving industrial growth, and reforms have eased the flow of capital, which makes it easy for industrialists to access it.

- Better GDP growth and shedding the tag of ‘Hindu rate of growth’ which used to hover around 3.5%. The GDP rate was high in the late 2000s and even touched the mark of 9%.

- The establishment of SEBI helped a lot in stock market growth, which further eased investments and the growth of the capital market.

- Forex reserves are at a record high and are still on the rise. This is important because the fall in forex reserves forced reforms from the government side.

Conclusion

- Reforms are a constant that must be pursued with changing time and economic scenario. It helps bring positive changes in all sectors of the economy, whether agriculture, services or manufacturing.

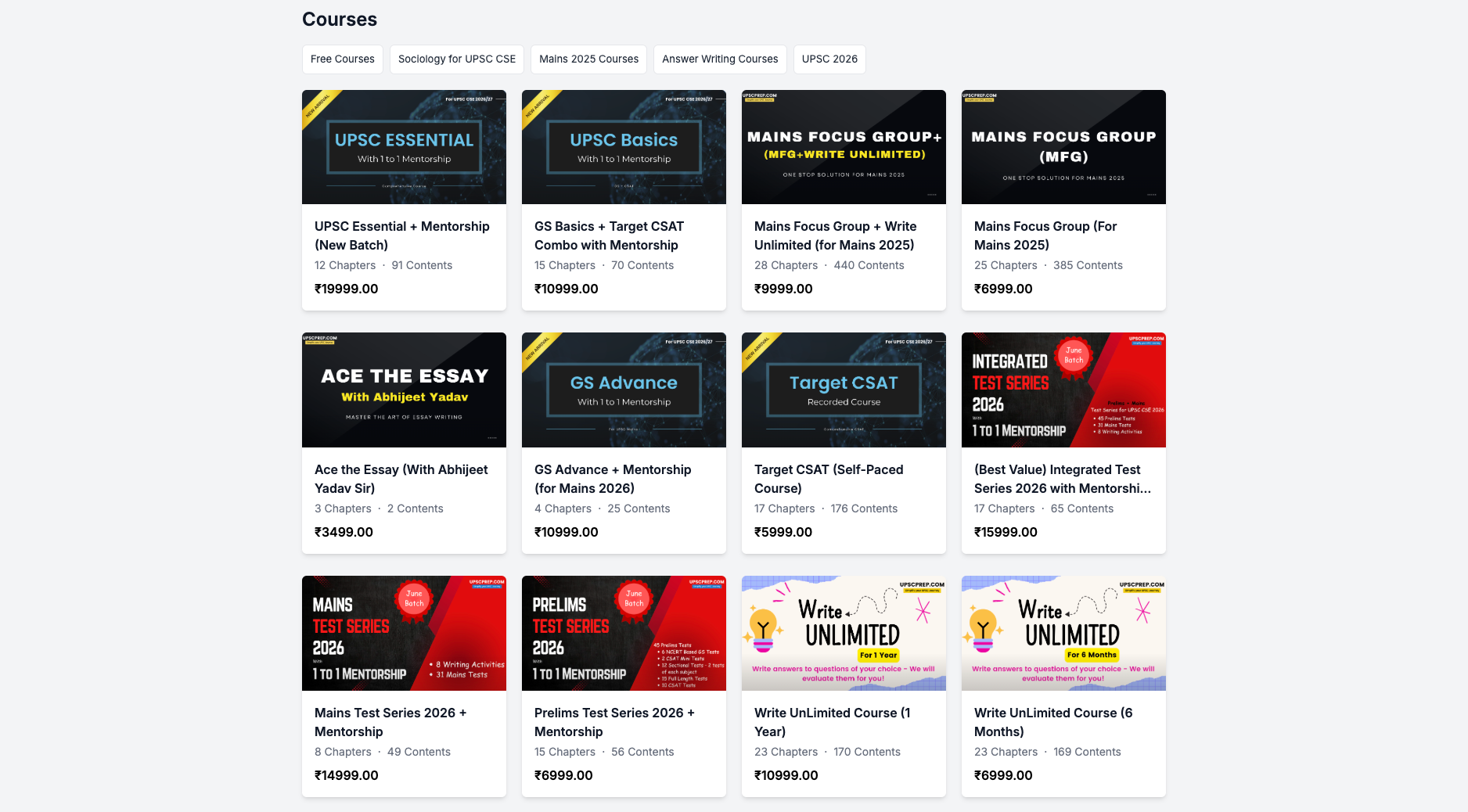

Courses by UPSCprep.com

A comprehensive range of courses meticulously designed to help you cover the syllabus in phases, without overwhelming you with long classes, ensuring you have ample time for self-study.