Table of contents

Context

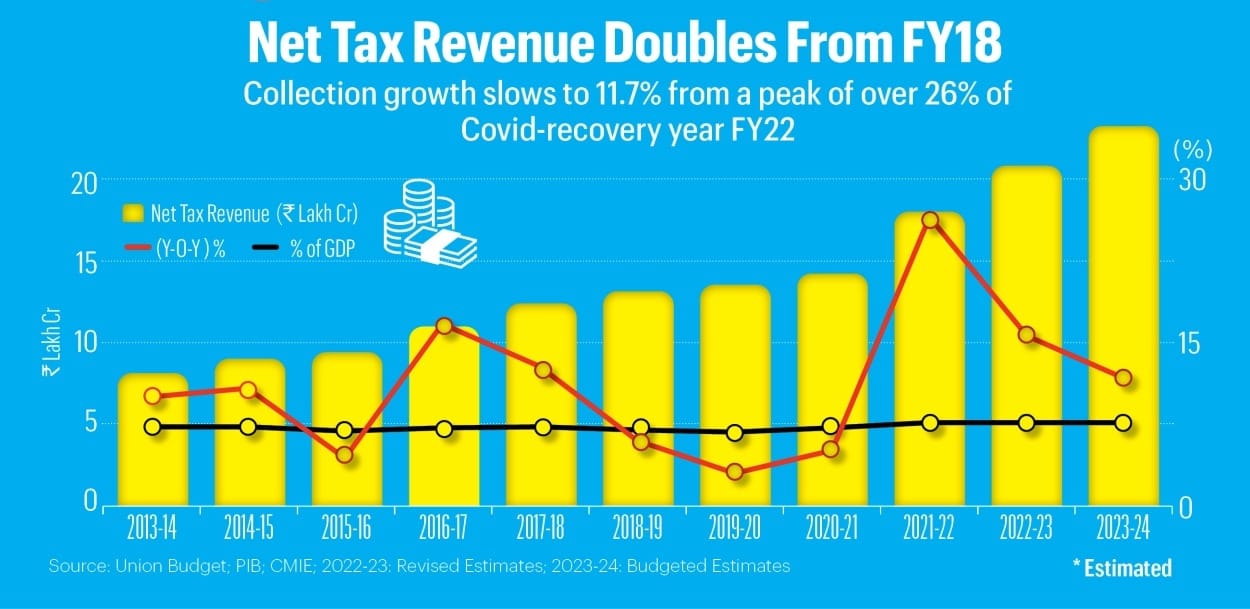

According to Revenue Secretary Sanjay Malhotra, India’s tax-to-GDP ratio is to hit a record high of 11.7% of GDP in 2024-25.

- It is led by an uptick in the more ‘equitable’ direct taxes.

- The government will continue to simplify and rationalise the tax regime to reduce disputes, litigation, and intrusive means of enforcement.

FAQ: What is "Tax-to-GDP Ratio"?

Reasons for the projected increase

- Uptick in Direct Tax Collection

- There is an increase in the collection of direct taxes, which includes both corporate and personal income taxes.

- This is a significant contributor to the rise in the tax-to-GDP ratio as direct taxes are generally more stable and grow with the economy.

- Retention of New Tax Regime Adoption

- The new tax regime in personal income tax, which offers lower tax rates in exchange for foregoing deductions and exemptions, is expected to attract more taxpayers.

- This simplification can lead to increased compliance and higher tax revenue.

- Government Reforms

- The government is continuously working on reforming the tax regime to reduce disputes, litigation, and intrusive means of enforcement.

- A more efficient and taxpayer-friendly system can lead to better compliance and higher collections.

- Economic Growth

- The nominal GDP growth is expected to rise by 10.5%, and tax revenues are projected to grow at 11.5%.

- The economic growth enhances the tax base as both corporate profits and personal incomes increase.

- Rationalization of Indirect Taxes

- The article mentions the prospect of rationalizing Goods and Services Tax (GST) rates and reviewing the rate structure, which may contribute to more stable and possibly increased indirect tax collection.

- Tax Administration Improvements

- There is a likely emphasis on improving the efficiency of tax administration, making use of technology to widen the tax base and to crack down on tax evasion and avoidance.

- Reduced Tax Litigation

- By simplifying the tax code and reducing the grounds for disputes, the government can reduce litigation, which often ties up tax revenue in lengthy legal processes.

- Sectoral Trends

- Although not explicitly mentioned in the article, a shift towards more service-oriented and formal sectors typically results in higher tax collections.

- Reduced Tax Rates with Broader Base

- The strategy of potentially lowering tax rates but broadening the tax base can result in higher tax revenue, as more entities are taxed but at a lower rate, which can encourage compliance and decrease the shadow economy.

- Fiscal Discipline

- The government's commitment to fiscal discipline, as implied by the promise to continue simplifying and rationalizing the tax regime, suggests an environment conducive to higher tax revenue collection.

These factors combined suggest a robust approach to fiscal management that could lead to the tax-to-GDP ratio in India reaching the projected all-time high by FY25.

What Is a Good Tax-to-GDP Ratio?

A tax-to-GDP ratio of 15% or higher is believed to ensure economic growth and, thus, poverty reduction in the long term, according to the World Bank.

Policymakers use the tax-to-GDP ratio to compare tax receipts from year to year because it offers a better measure of the rise and fall in tax revenue than simple amounts.

Tax revenues are closely related to economic activity, rising during periods of faster economic growth and declining during recessions. As a percentage, tax revenues generally rise and fall faster than GDP, but the ratio should stay relatively consistent, barring extreme swings in growth.