Table of contents

Introduction

The MSME sector constitutes a vast network of over 60 million units and employs 120 million people, contributing around 30 percent to the GDP. It accounts for about 45% of manufacturing output and around 40 % to total exports.

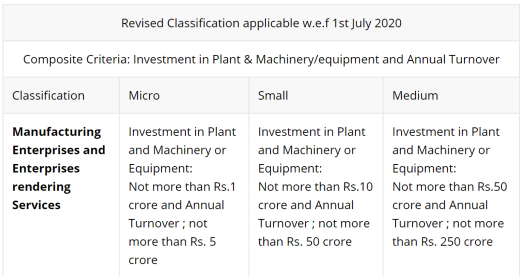

Definition of MSMEs

Manufacturing/Service Enterprise (Investment)

- Micro: upto 1 Crore

- Small: upto 10 Crore

- Medium: upto 50 crore

Turnover (5 times investment)

- Micro: upto 5 Crore

- Small: upto 50 Crore

- Medium: upto 250 Crore

Significance of MSMEs Sector

- Employment generation: employs about 120 million people

- MSME sector accounts for 30% of India’s GDP

- 45% of exports

- Income augmentation,

- Building rural infrastructure,

- Women empowerment (14% MSMEs are women led)

- Promotion of traditional goods, innovation etc.

Challenges

- Limited capital and knowledge

- Technological Backwardness

- Inadequate infrastructure facilities including access to power, water, & road

- Low production capacity and constraints in modernisation & expansions which inhibits the sector to profit from ‘economy of scale’

- Ineffective marketing strategy

- Non-availability of skilled labour at affordable cost

- High competition from cheap import

- Lack of adequate forward and backward linkages

- Financial constraints

- Poor access to formal capital: Only about 8 percent of MSMEs are served by formal credit channels.

- Low financial and digital literacy

- Limited funding capacity and accessibility of NBFCs and SFBs

Recent initiatives for MSMEs Sector

- In-principle approval for loans up to Rs. 1 crore within 59 minutes

- Interest subvention of 2%

- All CPSUs to compulsorily procure through GeM portal (25% target)

- 4% SC/ST led MSMEs and 3% from women led

- Technology Centres (TCs) and Extension Centres (ECs)

- Equity infusion for MSMEs through Fund of Funds

- Use of Fintech is being encouraged

- MUDRA Loans

U. K. Sinha Committee Report

(Expert committee on MSMEs) Report by RBI. Recommendations:

- Review the MSME Development Act as a comprehensive and holistic MSME code

- Change definition from current investment based to turnover based

- Strengthening government e-market portal.

- State Finance Commission and Khadi and Village Industries Commission should redirect their focus in promoting the MSME sector

- Exit policy should be their for out-of-court assistance to MSMEs

- Market support to MSMEs. Eg. External service provider giving customised solutions to struggling enterprise

- Improving access to technology

- Setup a National Council for MSMEs to facilitate coherent policy outlook & Unity of monitoring

Rainbow reforms for MSMEs

Access to credit, access to market, technology upgradation, ease of doing business and a sense of security for employees are five key aspects for facilitating MSME sector.

These reforms are for both manufacturing and service sector.

Easy access to credit

- loans of up to Rs 1 crore will be sanctioned in 59 minutes through a special portal as part of the Centre’s Micro, Small and Medium Enterprises (MSME) Support and Outreach programme.

- GST-registered MSMEs will get two per cent interest subvention

Easy access to market

- public sector companies will hav to compulsorily procure 25%, instead of 20%, of their total purchases from the MSMEs.

- Of the 25% procurement mandated from the MSMEs, 3% must now be reserved for women entrepreneurs

Technology Upgradation

- 20 tool hubs would be formed across the country, and 100 spokes in the form of tool rooms would be established.

Ease of doing business

- inspections of factories in the sector will be sanctioned only through a computerised random allotment and inspectors will have to upload reports on the portal within 48 hours.

- MSMEs will have to file just one annual return on eight labour laws and 10 central rules (earlier it needed to filed twice annually)

- Environment clearance under Air and water act on self certificate of MSME. Only 10% industries to be inspected

Social security to employees of MSMEs

Campaign to ensure all MSMEs are covered under social security schemes.

Concerns

- Risk of credit stimulus is the mis-allocation of productive economic resources

- Likely deterioration in credit standards as the financial institutions are pushed to lend aggressively to MSMEs

Important for Prelims -

- MSME Sambandh Portal - To monitor the implementation of the Public Procurement from MSEs by Central Public Sector Enterprises. (Mandatory 25% from SMEs)

- Udyami Mitra Portal - To provide ‘End to End’ solutions not only for credit delivery but also for the host of Credit-plus services by way of hand holding support, application tracking, and multiple interfaces with stakeholders. It was launched by SIDBI. It provides a unique match making platform to MSME loan seekers, lenders as also handholding agencies.

- MSME Sampark portal- To bridge gap between the Recruiters and Job Seekers.

- Samadhan Portal – It enables the MSMEs to directly register their cases relating to delayed payments by Central Ministries/Departments/CPSEs/State Governments. The information on the portal will be available in public domain, thus exerting moral pressure on the defaulting organizations.

Previous Post