Questions

- More than 17 years since passage of Right to Information Act, 2005 but access to information is still a big issue. Enumerating the challenges, explain the need for widening scope of this law. (15 marks)

- Corporate governance secures the interests of all stakeholders whether management or general public. What are the laws ensuring corporate governance and mention the challenges involved. (10 marks)

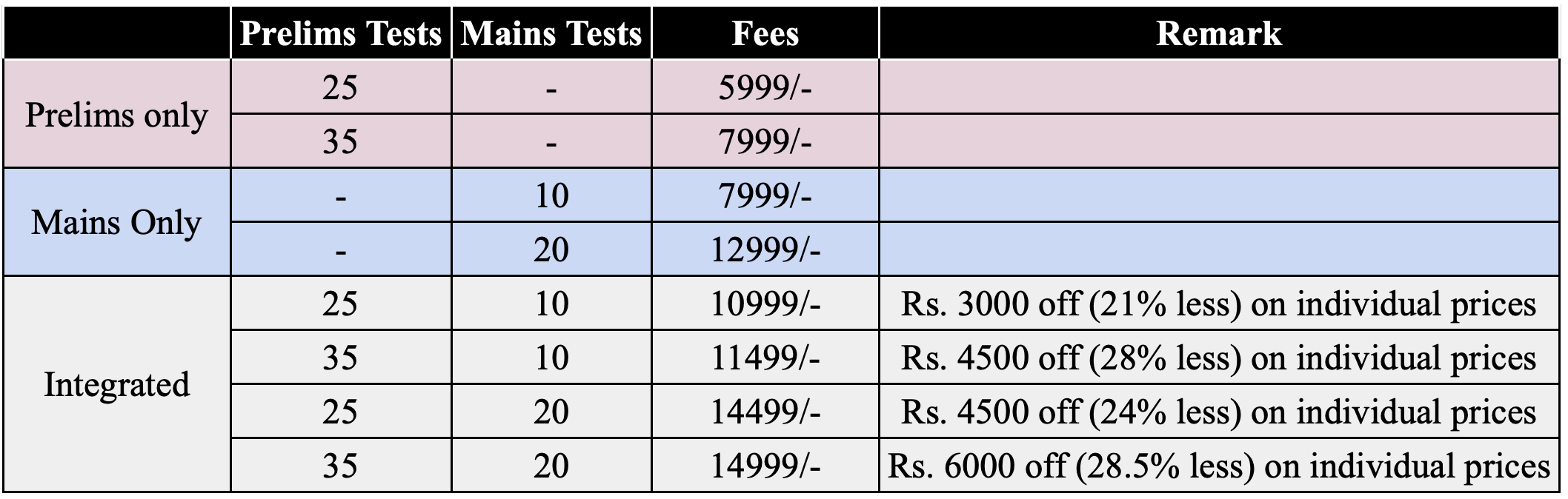

Integrated Prelims + Mains Test Series

For UPSC Prelims and Mains 2023

Model Solutions

Q1. More than 17 years since passage of Right to Information Act, 2005 but access to information is a big issue. Enumerating the challenges, explain the need for widening scope of this law. (15 marks)

Model Structure

Introduction

- India is in line to be the most populated country in the world but when it comes to development parameters, it lags behind. This is majorly due to lack of transparency and accountability of public officials whose mandate is to implement government schemes and eliminate disparities.

Main body

- To foster this accountability, the Right to Information Act was passed in 2005 to make democratic governments accountable. But it has not translated into access to information due to issues like-

- RTI amendment act 2019 which has limited powers of this law by giving parliament the powers to determine salary and service conditions.

- Misuse of the law due to lack of locus standi and frivolous RTIs for seeking information.

- High pendency and backlog of applications.

- Many exceptions and being antithetical to Official Secrets Act 1923 thus bringing in more secrecy rather than transparency.

- Poor enforceability as information commissioners lack such powers.

- Low awareness among citizens to avail advantages of such law for their own benefit.

- In this scenario, scope of the law needs to be widened by-

- The 2013 Chief Information Commissioner (CIC) ruling says that political parties must be declared as public authorities but CIC is powerless to enforce its own ruling.

- Association for Democratic Reforms opined that political parties receive huge indirect funding in the form of tax exemptions, free airtime, free tracts of land etc. So just like NGOs, trusts etc who are public authorities under the act, political parties must be treated the same way.

- With the rise in fake and paid news, it's time to bring the fourth pillar of democracy, i.e. the media under RTI act to ensure credibility of the news.

- Some aspects of corporate governance can be brought under RTI because they hugely fund political parties and there is ample scope of quid pro quo.

Conclusion

- At the end, it can be concluded that although there are lots of benefits of widening scope of RTI act but the real challenge is that like politicians, the media, corporate houses, NGOs too

Q2. Corporate governance secures the interests of all stakeholders whether management or general public. What are the laws ensuring corporate governance and mention the challenges involved. (10 marks)

Model Structure

Introduction

- Corporate governance is a framework which helps balance interests of a company's stakeholders, such as management executives, customers, shareholders, financiers, etc by ensuring business of a firm is done ethically in compliance with rules and regulations.

Main Body

-

There are many laws and regulations ensuring that corporate governance norms are adhered to, like-

- Companies Act 2013- provides a formal structure by ensuring disclosures and compliance norms through provisions like independent directors, general meetings, proper board and meetings, audit committees etc.

- Guidelines by regulatory bodies like SEBI for protection of investors and use of best practices in governance.

- Supplementing laws like Foreign Exchange Management Act,1999 and Competition Act 2002 to ensure fair practices.

- Institute of Chartered Accountants of India’s accounting standards, including disclosure of financial statements under Companies Act 2013.

- Also, secretarial standards issued by the Institute of Company Secretaries of India.

-

Despite this framework, challenges include-

- Difficult to monitor results when norms are disobeyed by companies. Mr. Subramaniam was re-designated as chief operating officer of NSE without taking the nomination and remuneration committee into confidence.

- Inadequate quantum of punishment thus ineffective deterrence as seen in NSE case where meager penalty of Rs 2 crore is said to be too low by financial experts.

- Dereliction of duty by public interest directors as they didn’t take any action against Ms. Ramakrishna when fully aware of information being exchanged with a third party.

- Use of tax havens to get low taxation benefits and keep financial secrets intact.

- Concentration of powers as a single shareholder or large family controls a large group of companies.

- Even though SEBI separated the roles of the Chairperson and the CEO/MD of a company as per the Uday Kotak committee, this was diluted and made voluntary.

Conclusion

- For better investigation and prosecution, forensic auditing can be used along with regular updation of double taxation avoidance agreements for better enforcement of laws and plugging of loopholes.